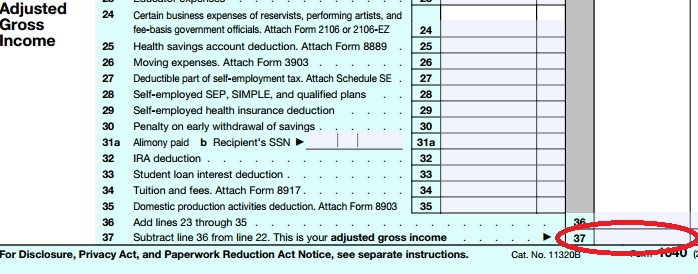

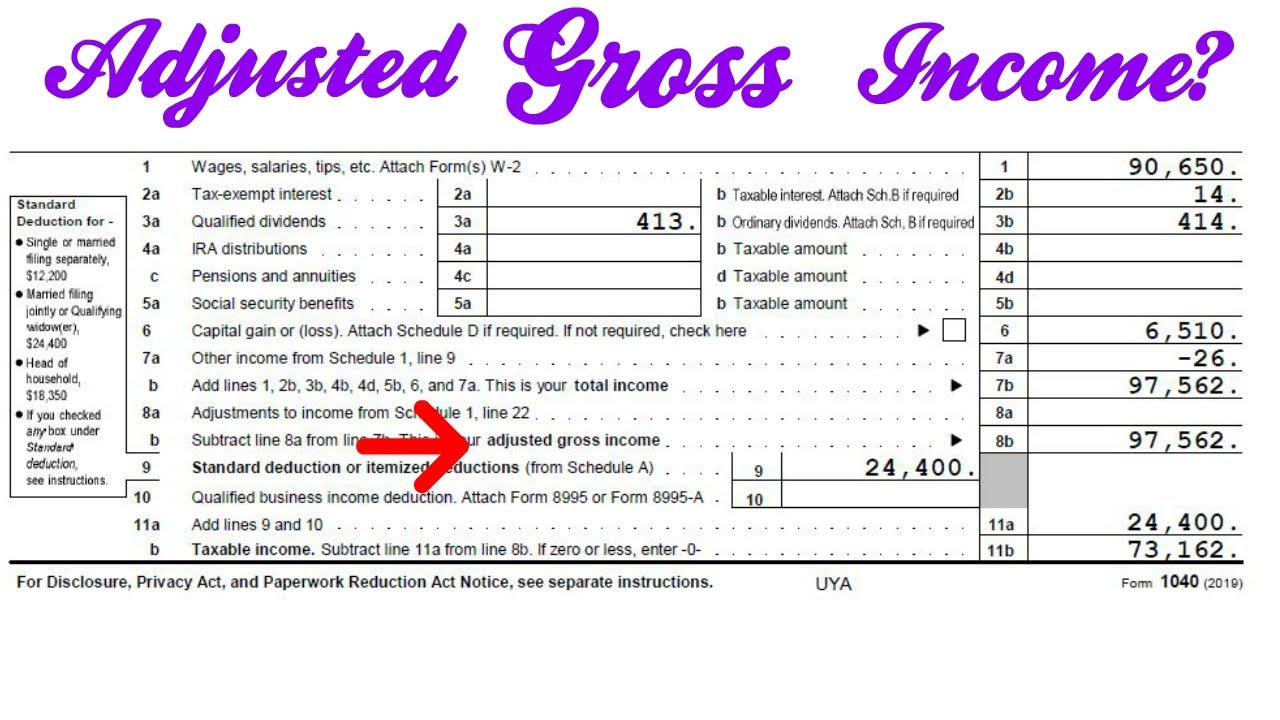

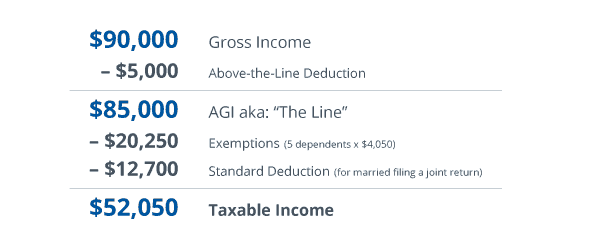

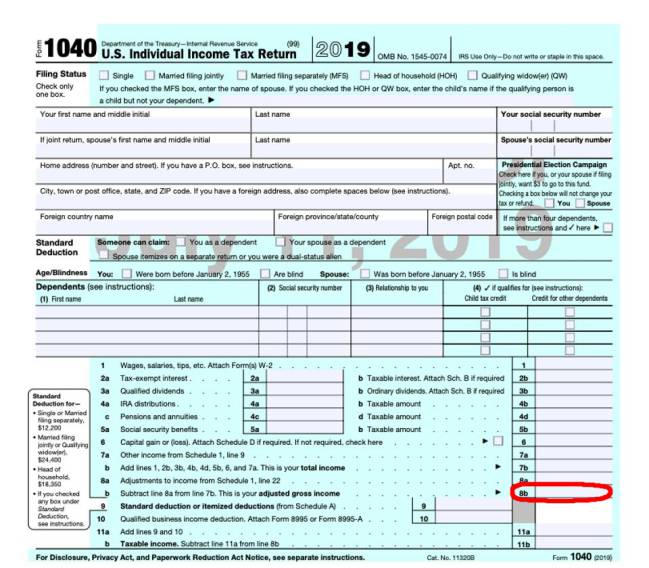

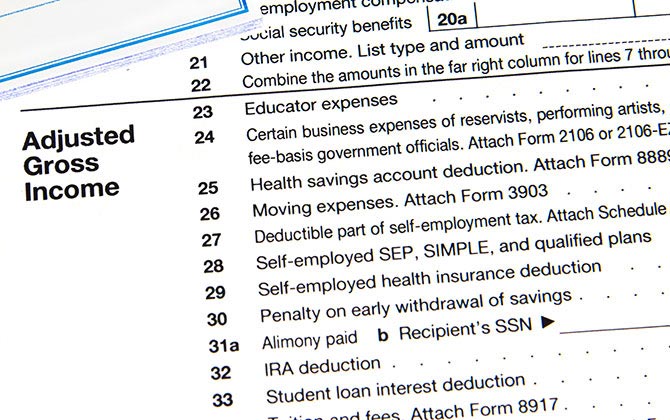

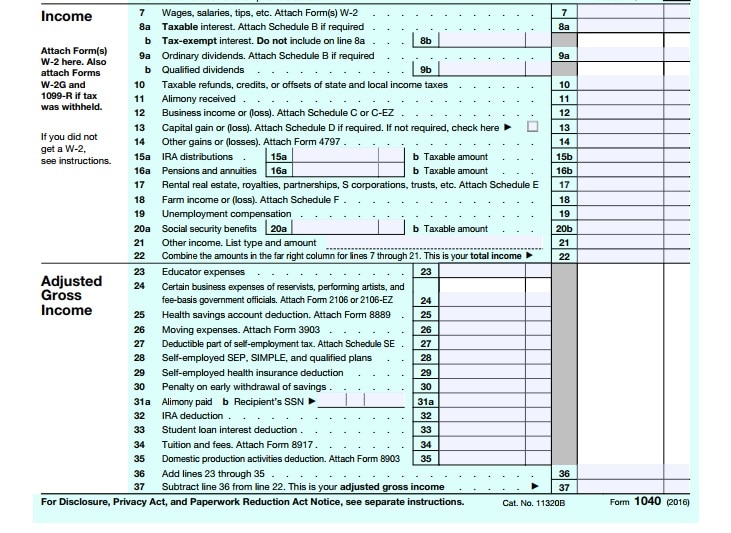

737 Worksheet Form California Registered Domestic Partners Adjustments Worksheet — Recalculated Federal Adjusted Gross Income

Who is NOT required to file a NY State NR Tax return? If you did NOT have any US-source income at all in 2014, you are NOT required to file a

.png)